USF – A Tax Increase for All Americans

As Tax day is upon us, we have seen the largest divide among people who pay tax and those who don’t. More than 40% of Americans do not pay or owe any federal income tax largely due to the earned income credit and stimulus checks and programs. So on the surface, you could say that the President has delivered on his promise to not increase taxes on individuals making less than $250K, however, what you don’t see is the new hidden taxes, fees, and increases regulatory costs that does have an impact on every American.

As with any political issue, you can almost spin a positive answer (or argument) in any direction depending on what you include and exclude. In today’s tax environment, government programs are greatly increasing expenses while at the same time saying they are very unfunded. This is not sustainable and the money to pay for the programs has to come from somewhere.

For better or worse, the rich can not support the entire nation, so the money has to come from the both the rich and non-rich. The difference is this, the new taxes on the rich are advertised and seen as just, the taxes on the non-rich (due to vast opposition), are not advertised, in fact they are strategically hidden or classified as fees (such as California did to get around the complexities to pass new taxes).

Unless you are an expert in virtually every tax and fee assessed on every product or service, your taxes can go up with out you knowing it.

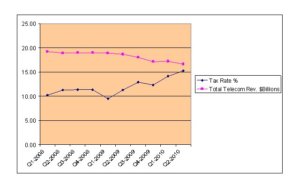

Here is a very good example of a tax that has gone up 41% on virtually any every person using Telecom services.

It is called the USF, look on your phone bill and you will see this fee. From 2000-2008 it bounced between 9.5-11%. Starting in 2009, it has gone from 11% to 15.3%. A 41% increase.

If you spend $60 a month on telecom services, your tax went from $6.60 to $9.18. See chart below:

Here is the next interesting fact. The more tax collected, the total telecom revenues predictably decrease. Why is this, simply, taxes assessed on businesses are typically passed to consumers. In this case, the tax amount passed to the consumer could be the difference between affording the service and not affording the service.

There is a fine line between to much tax and not enough, but it is clear in the case of the USF we have crossed the threshold.

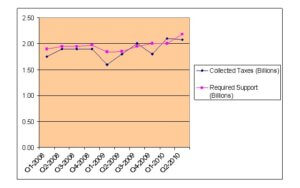

In the second interesting fact, you can see that the required support has substantially gone up which is inline with government spending increasing across the board.

USF Revenue and Collections

I find it hard to say with a straight face that taxes and fees have only gone up for the wealthy. This is simply not the truth, but the media likes to spin it this way. All facts above regarding the USF can be found on the FCC’s website in the quarterly filings that contain the rates and collections for the program.

It is important to understand, if government spending increases, everyone will pay the price. If someone says otherwise they are lying, there is simply not enough taxable income on the wealthy to pay for all the program increases.

We should not focus our attention on raising revenue, it should be focused on getting quality programs that help the people that truly need it and don’t waste money on programs that do nothing. The USF is one of the biggest wastes of money. Initially it was a good tax to help build phone lines to expensive areas, however, these areas are built and depreciated. Assitance to companies should substantially be reduced, but as with any government program, companies and people get addicted to the subsidies and the programs never cease or reduce in size.

Conversations