Transportation Proposal 2018-19 Budget (aka the gas tax funding)

Now that “the gas tax” proposition failed California drivers are on the hook to pay/fund SB1 budget expenditures. Both sides tried to mask the real issues which made it hard for anyone to know what was at stake. While bot sides had some elements of truth, most were exaggerated.

What SB1 does or the “Gas Tax” is outlined in the budget proposal below. It shows where the money is going to be used and how. It does provide a wide range of funding, but one should remember this funding should already be there and giving this funding does not hold our politicians accountable for wasting the funding from the past.

Just do a bit of research on California gas tax and you will find a very complex web of initiatives and even measures California residents passed to keep the money for roads. In many instances the money has been re-diverted at the cost of the roads and safety. Will this funding stay or be moved in the future? We do not know, but the track record is not good.

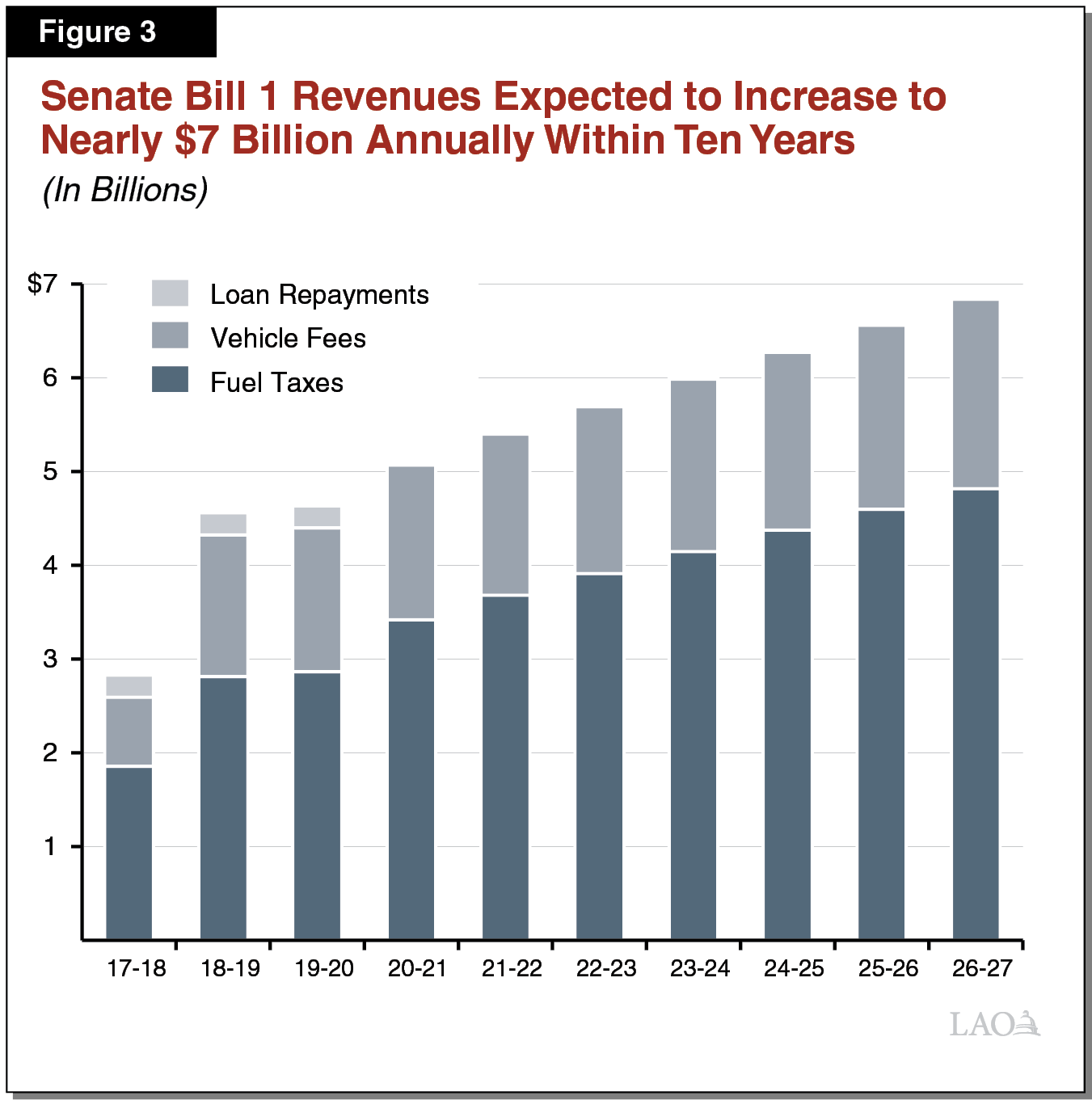

One last thing to note, the Gas Tax increases and takes a lot more money in out years (see chart as we are in 2018/2019 phase). It also leaves an open door for future increases if funding is not enough.

I always believe a sign of a bad bill is one in which the heaviest burden is not felt until enough time has passed to not be able to do anything about it. This is one of those.

Yes we need to fund our road safety, but not in this manner. You will also see in the budget proposal they are not even shy about calling out some of their own waste and failures. Look at the DMV portion and you will see they admit to failing a project that cost over $120M and the gas tax will give them round two.

Be prepared for the coming years to become a lot more expensive to drive in California (see graph below). Last note, your tax dollars are also funding a pilot program to figure out how to tax you based on the miles you drive.

Senate Bill 1 Increased Several Taxes and Fees

|

Old Rates |

New Ratesa |

Effective Date |

|

|

Fuel Taxesb |

|||

|

Gasoline |

|||

|

Base excise |

18 cents |

30 cents |

November 1, 2017 |

|

Variable excisec |

variable |

17.3 cents |

July 1, 2019 |

|

Diesel |

|||

|

Excisec |

variable |

36 cents |

November 1, 2017 |

|

Sales |

1.75 percent |

5.75 percent |

November 1, 2017 |

|

Vehicle Feesd |

|||

|

Transportation Improvement Fee |

— |

$25 to $175 |

January 1, 2018 |

|

ZEV registration fee |

— |

$100 |

July 1, 2020 |

|

aAdjusted for inflation starting July 1, 2020 for the gasoline and diesel excise taxes, January 1, 2020 for the Transportation Improvement Fee, and January 1, 2021 for the ZEV registration fee. The diesel sales taxes are not adjusted for inflation. bExcise taxes are per gallon. cVariable rates set annually by the California Department of Tax and Fee Administration. The current gasoline variable excise tax rate is 11.7 cents. The rate has ranged from 9.8 cents to 21.5 cents in prior years. The most recent diesel excise tax rate was 16 cents. This rate ranged from 10 cents to 18 cents in prior years. Senate Bill 1 converts both variable rates to fixed rates. dPer vehicle per year. Both fees are new, though the state levies other similar fees on vehicles, such as vehicle license fees and registration fees. ZEV = zero‑emission vehicle. |

|||

Arguments Presented By Both Sides

No on 6

Prop 6 will make road conditions worse and jeopardize the safety of California drivers. Furthermore, in an emergency, every minute counts — so safe and well-maintained roads help ensure that first responders can arrive at the scene quickly and save lives. Prop 6 could delay response times and makes our roads less safe.

Yes on 6

1) it costs you a lot more than you think – the tax hike will cost the typical family of four $779.28 more per year in taxes

2) it won’t fix our roads – this is a blank check tax hike that has already been diverted away from road repairs.

Conversations